So what happened at Satyam? This will be the first of a two part series trying to bring in some perspective the sordid Satyam scandal. Rather than the chronology of events, looking at the people in the plot is perhaps more enlightening and is definitely more interesting.

It is useful to restate what the exact admitted crime is till now – A group of people stole money out of a public company. Period. The rest of it, the how (fraud, forgery), the who (senior executives, internal and external auditors), the why (possibly to buy stuff ranging from acres and acres of land to crore costing telescopes), the when (close to a decade), what now (company getting sold as a whole or in parts) all come after that.

This post will concentrate on the side actors.

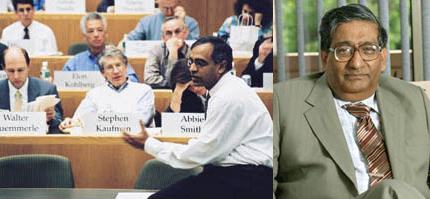

The Professors

It was at least five years ago that I first saw Prof.Krishna G. Palepu on television. Giving an interview to the CNBC Anchor along with his colleagues from Harvard Business School, Mr.Palepu was saying “this proves how good I am at selecting companies to give advice to” with a wink and a toothy smile. Please don’t think of this as schadenfreude – it is just to record the incredible irony of Mr.Palepu, a celebrity academic who teaches Accounting and Ethics and also instructs companies on how to make their boards more effective, being present in the middle of one of the biggest accounting and ethics scandals in history.

The bigger question is that if Prof.Palepu and Prof.Rammohan Rao, the other leading management academic caught in the scandal, are unable to do justice to the role of an independent director, can anyone? If independent directors are just another bunch of people who are completely dependent on the data given by the management as it is being claimed now, can anyone ever fulfill the fiduciary role which the law and their title seems to imply they perform?

Also, can anyone have an adversarial relationship with someone who pays them a few cool crores for a very few days of committed work every year and for advices like “ensure that the new businesses also has the synergies?”. And that is in addition to the consulting jigs.

Of course, no one should be fully blamed for everything happening in any organization that they are associated with and the expertise of Prof.Palepu and Prof.Rao may indeed qualify them for such money. What has been really disappointing from the good professors is that considering that they are some of the foremost academics and practitioners of their profession, they did not come clean with a public statement as to what happened and why. Perhaps they don’t understand that in the 24×7 media cacophony that we live in today, a no comment is indeed a bad comment when you are caught in something sleazy.

If thinking of the good old professors made you tired as thinking of good old professors is intended to make you feel, spend a few seconds imagining the board meeting at another public company in India – Jet Airways. My guess is that the independent director Aishwarya Rai and independent director Shah Rukh Khan enacts scenes regarding corporate governance written by another independent director Javed Akhtar.

[advt]

The Bean Counters

I am the son of an auditor. My dad used to be an auditor for the government and his job involved traveling all around and verifying the records of organizations ranging from major government departments and government owned companies to super small panchayats and even some temples. Sometimes his report was the only thing standing between the corrupt bureaucrat and the contractor screwing the taxpayer and the citizen. The challenges and the temptations of the job for a (not that well paid) government accountant in a developing country is indeed very different from someone who works in one of the Big Four firms, and indeed the right parallel maybe an MNC executive.

But not quite. Auditors of all stripes share a very important trust vested in them by society at large – Independent external audit is, many a time, the only safeguard against corruption, insider old boy dealings and fraud.

And the collusion of an auditor in a fraud is extremely deplorable due to that. Prime Face, it seems extremely unlikely that a fraud lasting this much time, for this much money could have happened without open collusion with the external auditor.

And the reaction of PWC has been even more deplorable. Initially, trying to wait out the public reaction quoting ‘customer confidentiality’, they then decided to throw a bunch of legalese which means ‘shit happened and we don’t know nothing.’ Their reaction brings into question why there should be such a system in which taxpayer pays them enormous amount of money hoping that they will do basic due diligence and if all that they do is dependent on the management of the enterprise they audit, it is a legitimate question why such a bunch of people should exist.

The Sidekicks

Prima facie, the internal finance department as a whole should have colluded in the fraud and prima facie, most of the senior management would have known at least implicitly that something was amiss. One would have to stretch the imagination that some of the basic questions raised about Satyam years ago – why would a company sitting over more than a billion dollars in cash be having a fifty million dollar debt on its balance sheet, would have completely escaped the notice of everyone in the senior leadership. In fact, the inconvenient fact that more than a few of them seem to have dumped the stock options they owned in too convenient a time makes them liable to answer some uncomfortable questions.

In the next post, we will look at the man behind the fraud, the context and the implications.

This quote from the irrepressible Tom Peters is the most fitting one to sign off.

In 2002, I tried (without success) to induce Stanford University to retract my MBA. Here’s why: The dean of the business school when i got my degree there was Robert Jaedicke. He was also an accounting professor, and I took advanced accounting course while I was a student. I last saw Jaedicke, 30 years later, on TV. He was testifying about his involvement in Enron fiasco. Not only was he an Enron board member – he was the chairman of the board’s Audit Committee. Yet he claimed he had no clue about the truckload of peculiar transactions that brought the company down!

When a guy who served as Enron’s audit boss…. the last bastion of bean counting… invokes the “clueless” defense, it makes you wonder: Did he have any clue as to the usefulness of the curriculum at the school where he’d been a dean? Did he have any clue as to what lessons I’d extract from his “advanced” accounting course?

Be the first to comment