Buddi is a simple budgeting program targeted for users with little or no financial background. It allows users to set up accounts and categories, record transactions, check spending habits, etc. Open source and free, it offers a cross-platform, extensible experience wrapped up in a simple tabbed interface.

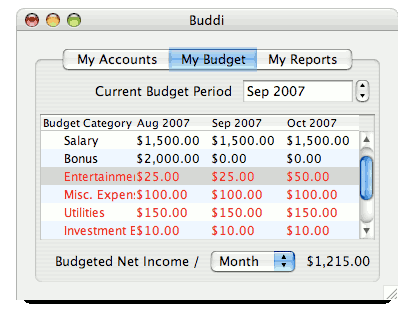

It can create new accounts from four credit types–cash, checking, investment, and savings–and five debit types–credit card, liability, line of credit, loan, and prepaid account. People can create their own account types, too, and take brief notes on an account. Strangely, the notes don’t seem to surface anywhere. Under the My Budget tab, you can add transactions under different default categories such as Salary, Auto, and Misc. Expenses, or you can create your own.

[advt]To enter a new transaction, double-click on the account or budget category under which it has occurred. From there, preexisting accounts and transaction titles have automatically been added to the drop-down menus to accelerate the new transaction creation process. Buddi generates reports and pie charts on command by income, average income, expenses, and net worth.

This is a good start in terms of features, but the execution leaves much room for improvement. There’s no context menu support, no drag-and-drop support, and the forced need to jump between tabs to see how expenses and income relates to specific accounts feels antiquated compared to newer financial management programs and Web sites. Buddi supports plug-ins, including ones that provide CSV and QIF import and export, there’s no native account importation or synchronization.

Be the first to comment