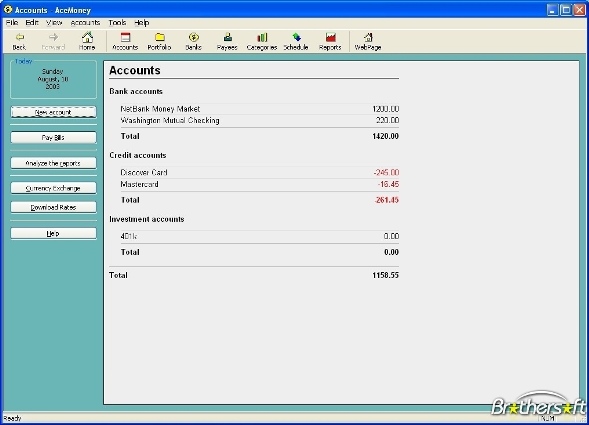

AceMoney Lite is free personal financial software that makes managing multiple accounts a breeze. You can manage your budgets, track multi-currency finances, analyze your spending habits, make transfers between accounts, and do on-line banking. You can start instantly without any prior accounting experience.

Set up your account, input all your regular outgoings and incomings (so you don’t have to do it the once) and then use the program to record all other transactions, letting you see exactly where you stand with regards to your finances.

Everything you expect from a personal finance package is here: record and view transactions, produce various reports and charts to help you track your spending, set up budgets, track investments and so on. It can also download statements from many supported worldwide banks to help you reconcile your accounts, plus you can even run an e-business using the program, which can automatically convert email notifications informing you of payments from online services such as PayPal, RegNow and Plimus into transactions, simply by cutting and pasting.

AceMoney Lite has all the same features as its bigger paid-for sibling, but only works with two accounts – if you have more, say savings, credit card and current account, you’ll need to upgrade to the full version. It is available in English, Spanish, Russian, Italian, Dutch, French, Portuguese, Polish, Hungarian and Swedish, with more languages to come. It supports all the features required for home or even small-business accounting.

With AceMoney, you can manage multiple accounts of different types: checking, savings, credit cards, loans, debt accounts, etc. You can even create your own specialized account types, such as cash allowances for the kids.

Features:

- Track your spending habits and see where the money goes

- Create and manage home budget

- Track performance of investments

- Do your financial math in multiple currencies

- [advt]Enjoy the convenience of on-line banking

- Don’t miss the next deadline for bills

- Double check

- Plan debts and mortgage payments

- Do e-business with AceMoney

Be the first to comment